Long-Short Strategy: An Integrated Equity Solution

Dual-Engine Growth Integrating Pre-Tax Alpha with Tax Harvesting

The Aris Investing’s Long-Short Strategy is a systematic, active extension building block designed to integrate directly as a completion sleeve within an advisor’s total portfolio architecture. While the strategy utilizes a long-short overlay to capture relative opportunities between securities, it is engineered to maintain a Beta-one profile, delivering a market-like experience with enhanced tax and alpha potential.

The Aris Long-Short Strategy: An Integrated Upgrade

Institutional Pedigree, Private Wealth Access

Aris brings institutional-grade sophistication, previously reserved for hedge funds, into a transparent, single-line format. The strategy is not just a quantitative model - it is a disciplined, factor-aware engine led by a team with decades of experience at premier global firms. This pedigree ensures that the operational complexities of shorting—such as borrow management and risk monitoring—are handled with the same rigor found at the world's largest investment houses.

A Complement, Not a Competitor

Unlike traditional "siloed" products that demand a total liquidation of current holdings, Aris is built as a complement. It is designed to sit alongside a client’s existing active managers or concentrated positions as a completion sleeve. We build an active extension overlay that optimizes the total portfolio’s tax and risk profile around your existing convictions, acting as a stabilizer rather than a disruptor.

Bespoke Advantages for the Architect

Every HNW balance sheet is unique. Aris provides the "bespoke advantage" by tailoring long-short exposure to account for specific client constraints. Whether it is managing around a large legacy technology position or neutralizing unintended sector overlaps from other managers, we provide the structural flexibility required for a truly customized total portfolio architecture.

Excess Returns to Support Structural Complexity

A sophisticated strategy must justify its own footprint. Aris utilizes a Multi-Factor Signal to tilt toward high-conviction factors, targeting excess pre-tax returns that are intended to offset the structural costs of the overlay. By seeking to outperform the benchmark through disciplined stock selection, we ensure that the strategy adds value on both sides of the ledger—pre-tax alpha and post-tax efficiency.

The Aris Long-Short Strategy: Built for Modern Portfolio Architects

Aris is designed for professionals who view the balance sheet as a dynamic system. By shifting from a "product" mindset to a "solutions" mindset, we provide the building blocks necessary to manage complexity at scale.

Modern RIAs: The Systems Integrator

For advisors who treat portfolios as integrated systems rather than a collection of siloed products, Aris acts as a completion sleeve - a centralized engine that harmonizes multiple active managers, ensures factor neutrality, and provides a consolidated view of risk and tax across the entire household.

Tactical Allocators: Precision Risk Management

Investors who require precision tools to navigate shifting market regimes utilize an active extension framework to maintain full market exposure while capturing relative performance dispersion. The strategy is built for those who value disciplined, daily risk monitoring and the ability to tilt toward high-conviction factors without abandoning their core benchmark.

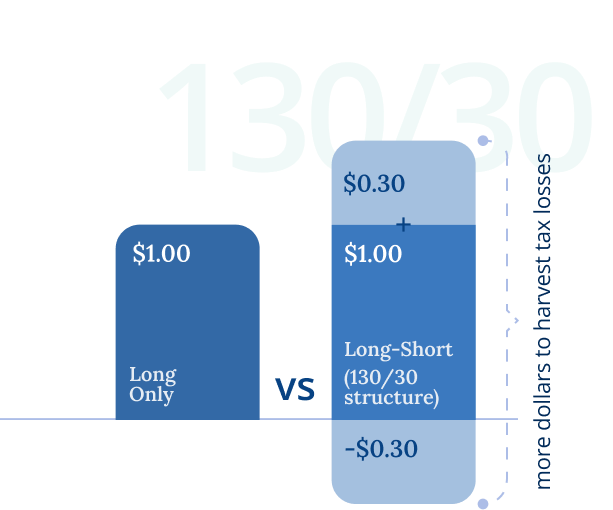

Tax Alpha Seekers: Structural Efficiency

Designed for high-net-worth clients who need a structural solution to unlock "tax-locked" portfolios and sustain loss harvesting over the long term. Aris is for the investor who understands that Tax Alpha is a primary driver of terminal wealth and requires an all-weather engine to generate offsets for private equity, real estate, or concentrated stock gains.

Alpha Diversifiers: Idiosyncratic Returns

For portfolios looking beyond broad market beta, Aris offers the ability to capture idiosyncratic returns through factor-driven tilts. By utilizing our Composite Multi-factor Signal to go long and short, we provide a diversifier that targets excess pre-tax returns, providing an additional layer of performance that is independent of simple market direction.

Designed to Support Bespoke Portfolio

Outcomes

A modular, institutional-grade equity building block designed to integrate into total portfolio frameworks, expand relative opportunity, and support disciplined risk and tax-aware investing for modern advisors.