Introducing The Aris Long-Short Strategy.

Learn more→

Experience the Power of

Model Portfolios with

The Aris Advantage

From risk reduction to strategic transparency, model Portfolios offer a range of advantages that empower investors.

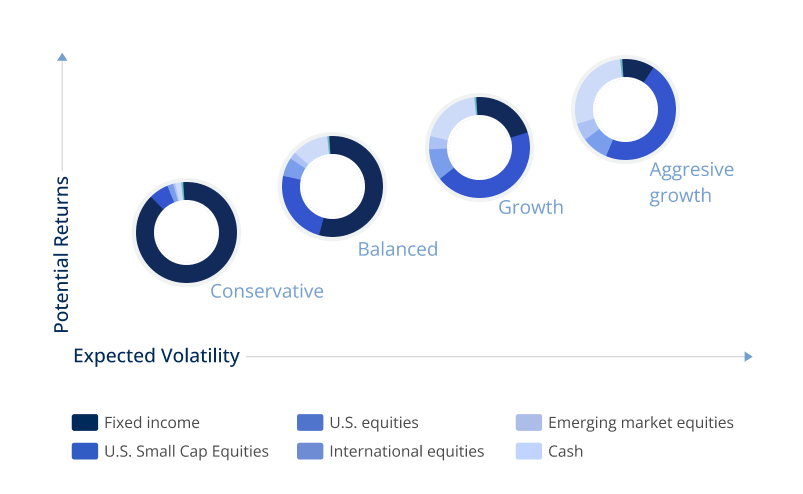

Diversification

By spreading investments across various asset classes, model portfolios minimize the impact of market volatility on your overall portfolio, providing stability during uncertain times.

Efficiency

Model portfolios streamline the investment process, enabling swift allocation and adjustments based on market dynamics, ensuring your investments are always optimized.

Customization

These portfolios are tailored to your unique risk tolerance and financial goals, aligning your investments with your individual preferences for a more personalized approach.

Transparency

With clearly defined strategies and holdings, model portfolios offer a level of transparency that empowers you to understand where your money is invested and how it's performing.

Why choose Model Portfolios

with

Aris Investing?

Tax-sensitive approach

Focus on minimizing tax liabilities through strategic asset location and loss harvesting.

Tax-efficient asset allocation

Allocate tax-inefficient assets to tax-advantaged accounts, optimizing after-tax returns.